Overview

There are many companies out there, such as AlphaClone, that let you pay a monthly fee in order to get access to their database of hedge fund holdings and “clones,” or model portfolios that track the stocks several prominent funds hold. However, there is no reason why any individual investor with a little bit of free time should have to pay for this service. In this post, you’ll see why: One of the most helpful things about the Securities & Exchange Commission’s EDGAR database is the fact that they let you set up an RSS reader to check for updates (filings) for a specific company whenever they are updated. This is great for non-professional investors with no subscription to Bloomberg Professional, since it is free and easy to set up. You can use whatever RSS reader you’d like, but Google Reader is our preference. Once you have a reader ready to go, following your favorite company or fund is quite easy. In this post, we’ll assume you want to follow some hedge funds.

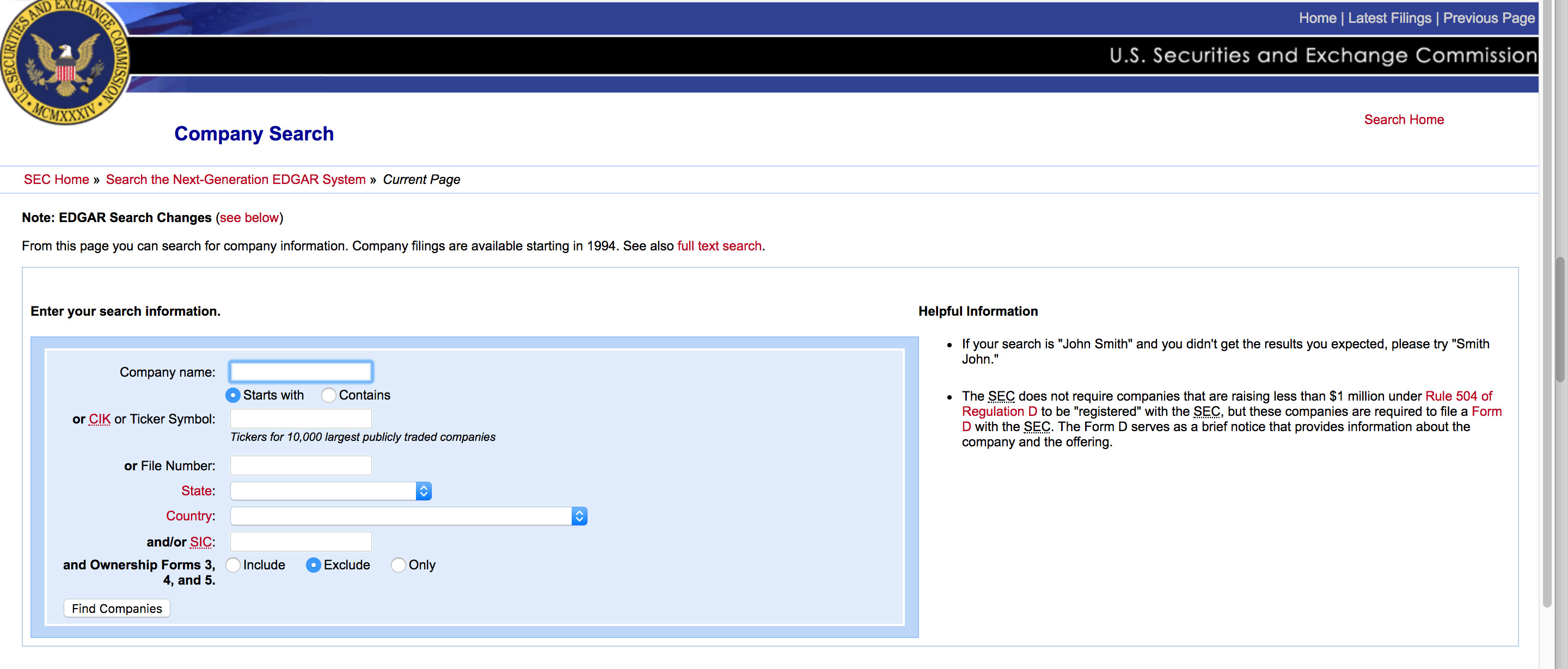

1. Go to the SEC EDGAR Search page, using this link. Getting to this page via the main site is a bit confusing. The screen you’re looking at should look something like this:

2. From the EDGAR search page, enter the name of the fund or fund manager (in some cases, the two are one in the same). The next step is sometimes challenging. If you’re lucky, there will only be two or three search results, so you can click on each to see which one is most regularly updated. Due to the structure of some of the larger hedge funds (i.e. some of them are registered offshore, or they have a separate management company and the funds are all treated as individual companies), there may be multiple entries. One example of this is Pershing Square Capital Management:

The manager, Bill Ackman, is one of the most widely followed managers. He recently took an activist stake in JCPenney and Fortune Brands (which distributes brands like Titleist, Jim Beam, and Moen), a move which has been widely analyzed since. In fact, following the announcement of moves like this of big hedge fund managers, the stocks involved will usually trade up quite a bit. Any investment by Warren Buffett in the past decade has exhibited this.

3. If you find yourself in a case where there are multiple companies to check, you may have to click into each one. Always look for the “company” with the most recent filings. In the above case, most of the shell companies called Pershing Square often only have one or two documents filed in their name. The reasons why this is the case are beyond the scope of this post. Regardless, even if the fund is not very big, it will still file quarterly reports known as 13F-NTs, which show the long and short equity positions that the fund held at the end of that quarter. These are especially useful when tracking value funds, since the managers like to hold positions for a long time. Even if you buy a stock right after the 13F-NTs are released, you still might gain a decent upside with some of their positions.

4. The final (and easiest) step is to start following them. Hit the RSS icon above the search results on the left side of the page:

5. Repeat steps 1-4 for all the hedge funds and/or companies you would like to follow. We do this for companies that we own, since it is a much easier way to catch press releases and earnings statements than waiting for it to come in the mail or read about it on the Wall Street Journal. If you get in the habit of checking Google Reader every day, then you can always see when something new is filed. The sidebar in Google Reader will then look something like this:

Feel free to find some of those names yourself! No other names come to mind? Check out this list from MarketFolly. A side note: avoid some of the well-known high frequency trading firms, such as Renaissance Technologies, SAC Capital, or D.E. Shaw. They might move in and out of positions too rapidly for any tracking mechanism to be useful. Look for some long-term value investors. Activist investors (such as Ackman) are also good since they try to create catalysts at the company to boost value to shareholders.

If you are interested in learning more about hedge funds, be sure to bookmark or subscribe to Market Folly. We have no affiliation to them, but it is one of our favorite blogs. They post an incredibly useful “What We’re Reading” column each week (see example) that aggregates some of the best articles and stories that week. All of the articles are generally pretty good, and it will also give you a much bigger list of investing blogs to follow.

===

Thanks for reading! Was this post helpful? Let us know in the comments, and be sure to add us to your RSS reader as well!