If you have worked any length of time in a salaried position, you are probably familiar with 401(k) plans or IRAs (individual retirement accounts). When you set up your contributions, you have to pick where you want to invest your money. Most people will randomly pick a few different mutual funds to invest in to “diversify” their portfolio, without any real knowledge of what they’re picking. If I had to guess, I’d say this is likely the only experience a lot of people have with mutual funds. It’s important to understand first what mutual funds are, and second, how they are different from a similar investment class, the ETF.

Let’s look at what mutual funds are first.

Apart from using them to fill your company 401(k), mutual funds are one of the easiest and most common ways that investors can “play the market.” In essence, a mutual fund is only an investment strategy that you can invest in. Vanguard, which I use, is one of the largest mutual fund companies in the world, and offers more than 100 different funds. The funds might be based either on a specific asset class (such as treasury bonds or precious metals), a retirement date (target retirement 2050), or an investing strategy (emerging markets fund). There is literally a fund for any specific investment type you can think of. If one company doesn’t have it, then another company will. Mutual funds are typically bought through the company that issues them. In the case of Vanguard, they don’t charge any commissions on any of their funds (with a tiny number of exceptions), so you can save more money by buying them directly instead of over an exchange.

An ETF, or exchange-traded fund, is different in that you can buy and sell it on an exchange, just like you would any other stock. If you want to buy an ETF that tracks the S&P 500 Index, the most popular ETF has the ticker SPY. You can buy and sell this as many times a day as you want, but like a stock, you pay your brokerage a commission each time it is traded. Like mutual funds, you can find an ETF for just about any investing strategy that you are interested in: VWO for Emerging Markets, GLD for Gold, etc.

To make things more confusing, you can buy both an emerging markets mutual fundAND an emerging markets ETF from the SAME company (Vanguard). The two funds will have virtually the same strategy and invest in the same companies!

So what then is the difference between ETFs and mutual funds?

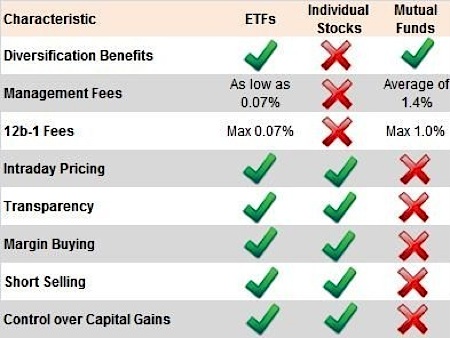

The difference between these two types of investments fall in a couple areas, some of which are worth noting: The main three I want to focus on are:

- Tax implications

- Trading costs and expense ratio

- Liquidity

Tax Implications

First, taxes. These are important to understand as an investor, because your returns are affected by them in a big way. The main distinction is between short term capital gains and long term capital gains. Short term refers to anything held less than a year, and long term is anything over a year. Currently, long term capital gains taxes are around 15%, while short term gains taxes are treated as ordinary income, i.e. 35% at the highest. This can make a huge difference to your annual return if you sell a stock that has been doing well before you hit the one year mark. Either way, you take a risk so it’s always important to not be emotional with investing (see rule #1).

The IRS treats an ETF the same way it treats a stock: you incur short term capital gains taxes if you sell it before the one year mark, and long term gains taxes otherwise. With mutual funds, this isn’t the case. Because of the structure of the funds themselves, each time you or any other investor sells a position, the fund manager needs to rebalance the portfolio by selling off increments of all the stocks represented by whatever strategy you’re tracking. The fund then incurs taxes on the parts of the portfolio it sold, depending on how long each security was held.

All that means is that you might still see short term capital gains taxes on your IRS forms at year end, even if you didn’t touch your portfolio. This can be frustrating for the long term investor, because it diminishes the use of making long term investments, as your effective tax rate will thus increase.

Trading Costs and Expense Ratios

Mutual funds are popular primarily because they tout low or no commissions and low expense ratios (ie the cost of ownership, such as 0.5% a year). If you buy an ETF, on the other hand, you pay a commission to your brokerage just as if you buy a stock. On top of that, you still might have to pay an expense ratio, but this often just comes in the form of a slightly lower return over the course of the year. [Expense ratios go to cover the salary of the fund manager, cost of issuing prospectuses, and other housekeeping costs]. Given this information, it might seem clear that mutual funds offer the better deal, especially if a company like Vanguard offers identical mutual funds and ETFs with the same strategy. However, let’s look at the final difference.

Liquidity

This is the final big area where mutual funds and ETFs differ. Liquidity is just a fancy name for how easily and fairly you can transact a particular security. A popular stock like Citigroup (C) has trading volume of about half a billion shares a day on average, so if you want to buy or sell shares, you will have no difficulty in getting a good price. Something more obscure like a credit default swap on Ford might be a little less liquid and therefore harder to come by.

Mutual funds are not very liquid, because that is built into their structure by law. When you log on to Vanguard.com at 10am on a Monday, you can choose to sell part of your holdings in your IRA account. You would think that your account would be credited with the value of the fund at the time that you sold, but this is not the case. In fact, you only get the value of the fund at the end of the trading day. This means that the fund manager has the entire day to sell the incremental portions of the stock fund, but only has to give you the price at the end of the day, regardless if it’s higher or lower than when you clicked “sell.” Likewise, when you buy, forget about getting the value of the fund then and there; you get the end of day price as well.

ETFs, quite simply, are as liquid as stocks, and when you buy or sell them at market, you pay or receive the value they are trading at right now.

Conclusions

So then, knowing all this, which makes more sense to own: an ETF, or a mutual fund? It’s hard to say. Conventional wisdom says to invest in mutual funds and leave your money there until you retire, but as I mentioned with the tax issue, you might end up paying a higher effective tax rate over the life of your portfolio than just long term capital gains rates, regardless if you don’t sell for 10 years. On the other hand, you incur trading costs with ETFs each time you buy, so that is an important consideration as well. In the end, you need to take time to do your own homework and figure out if a few $10 commissions is worth it when you could be saving 5% on your entire portfolio in the form of lower taxes your whole life.

As with all the other information on this site, I’m not a financial adviser so none of this construes financial advice. If you are unsure about an important financial decision, speak with a registered financial adviser.

Hope this was helpful! If it was, let me know in the comments below!