In the series I penned about the basics of investing, I talked about finding investments, buying them at reasonable prices, and knowing when to finally sell the stock you’ve been holding. But what if you are concerned that you will miss the right opportunity to sell the stock? What if you have a day job that doesn’t allow you to log on to your brokerage account to place any trades?

Stop Loss Orders

I want to talk about stop loss orders. Despite the confusing name, they can be really quite simple. This IS Investing Part Time, right? In effect, stop loss orders allow you to set predetermined entry or exit points (i.e. buy or sell prices) for a specific stock. For example, if you own a company that is currently trading at $25.00 per share and you are worried that it might drop rapidly, then you could set a stop loss order at $20.00. If at any point over the next few months you forget to check on this stock each day and it somehow drops to below $20, your brokerage company will automatically close your position and credit your account with the cash sale price of $20 per share.

Stop orders work in the other direction as well. Using the same example, if you think that the company is worth no more than $35 per share based on its current earnings, then you could set a stop order at $35.00. If the share price touches that intraday at any point during the next few months (until you cancel the order), then the position will be closed out too.

A Variation…

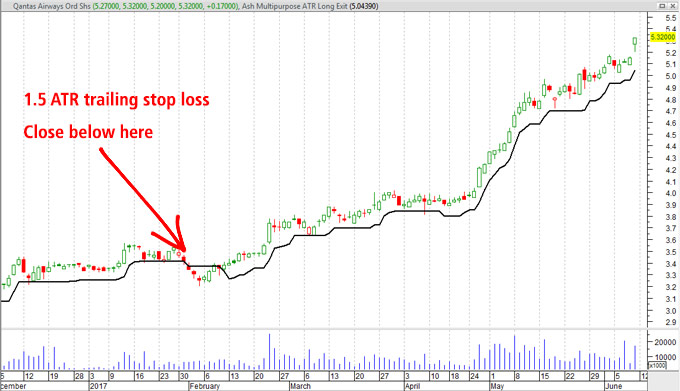

A variation of the stop loss order is the trailing stop. This is a bit more advanced of a trade. You can set it up as you would a regular stop loss order, except instead of setting a fixed price, you pick a percentage (say X). The trailing stop will literally trail the upward movement of the stock, and then be limited on the downside. Your brokerage will keep a running number that follows the stock as it advances, but stays put if it is declining. If the stock falls from its peak to an amount X percent lower, your stop order will be executed.

Note: I’m not sure all brokerages support trailing stop orders. If they do, they tend to be a little more expensive, because it is more active than a simple buy or sell order. I use thinkorswim, and here is what an order would look like on their system:

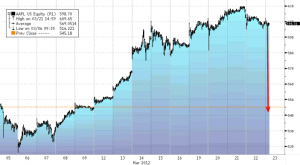

Here’s what it would look like graphically (for AAPL):

How to Manage Risk

As mentioned above, stop loss orders are great for those of us who can’t sit at a computer or keep an eye on the markets all day. We can manage risk by limiting our downside, and lock in profits for a trade that has already been going our direction. I try to have stop loss orders on all my trades, because I never know if I might not have a chance to close out a position and lose an extra 5-10% beyond what was necessary.

How do you figure out what price you should set as your stop loss? It all comes down to the concept of target price (see here for the post I wrote related to that). On the other hand, if you are choosing to place a trailing stop order, the percentage is more subjective. It depends more on your tolerance for risk. If you want to make sure you keep the most profit on a stock that then falls a great deal, a smaller percentage (5-10%) might be suitable. However, in setting a small trailing stop %, you run the risk of the price being hit solely due to day-to-day fluctuations of the stock. The last thing you want is for a stock to fall 5%, trigger your stop loss, and then proceed to rise 40% the next two months. Either way, you take a chance.